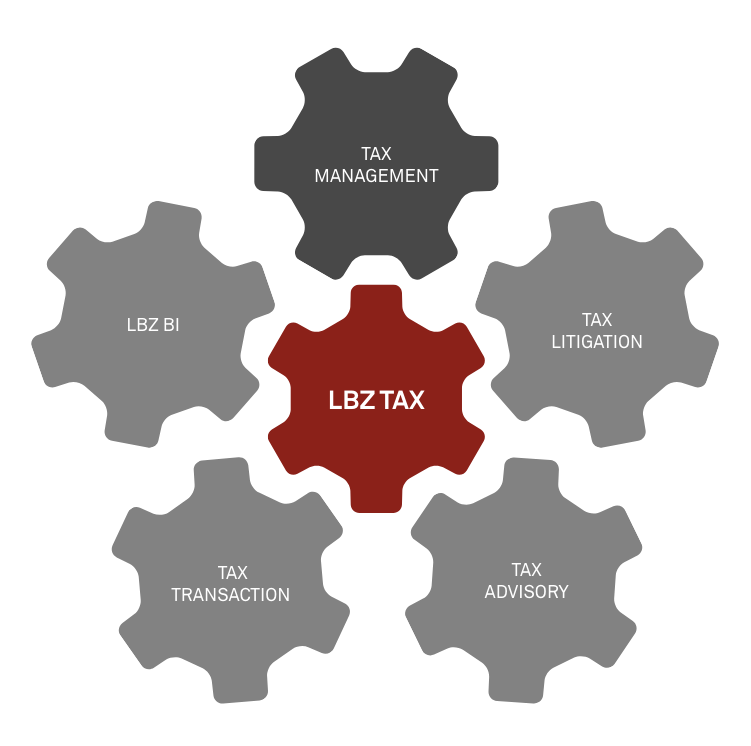

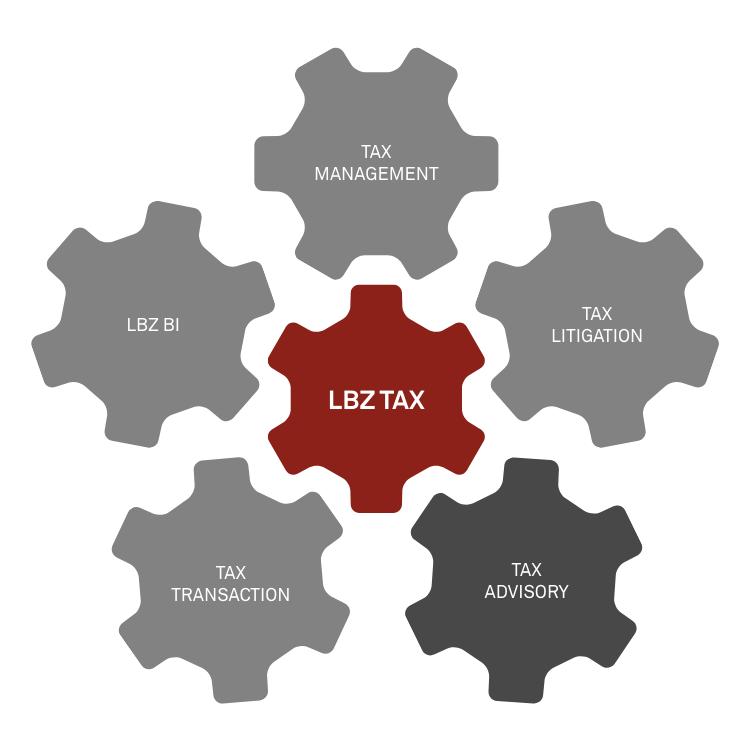

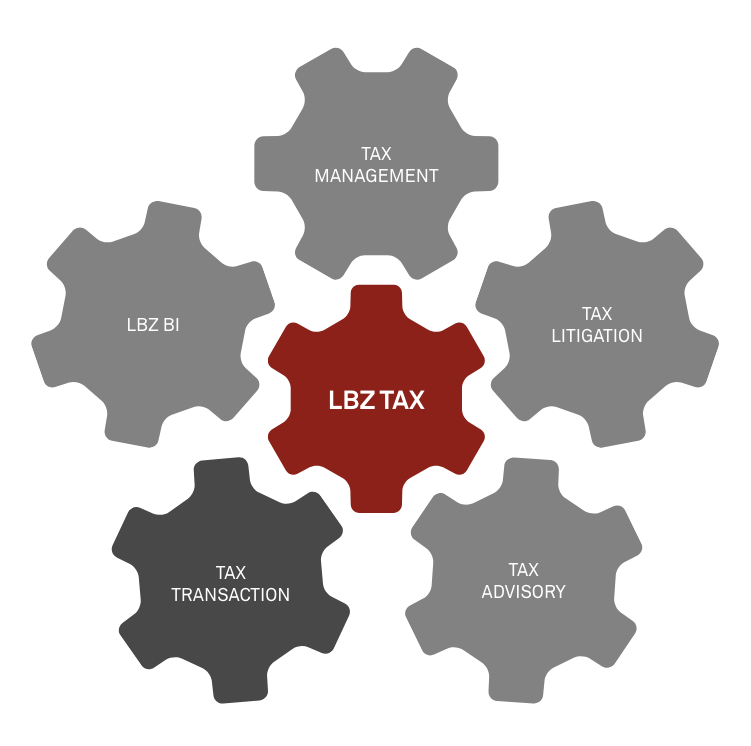

To obtain good results and be competitive, companies need to manage taxation properly, as the country has high tax complexity. With this in mind, we offer complete support, by means of a strategic partnership for the business, helping our clients have adequate costs and a secure tax operation.

Our tax law area has a highly experienced team, which associates technology with the best specialized vision, without leaving aside service customization.

In order to get an idea of our tax area performance, we managed to obtain for our client, in an isolated way, in a Refund Management project, BRL 300 million in federal tax credits and BRL 400 million in federal credits recovered in a Tax Review.

The services provided by the Tax Management team include:

The area has as expertise to unite Business Intelligence (BI) and the best consulting in good practices and opportunities.

By means of our Business Intelligence tools and professionals aligned and updated with tax legislation and case law, we point out consistent and detailed quantified opportunities.

It aims to serve companies that, due to the nature of their operations, generate more credits than they consume, resulting in accumulation to be offset or, at other times, refunded.

The purpose of this work is, through a comprehensive action involving tax, accounting, and litigation areas, which are associated with Business Intelligence to perform all the necessary activities to ensure that the right figures are duly recognized and refunded, plus adjustment for inflation calculated at the SELIC rate.

Fertilizers

Paper And Cellulose

Mining

Plastic

Chemicals

Steel Industry

Textile

Manufacturing and electronics

Sugar and alcohol

PIS/Cofins

Social security

IRRF/CIDE

IRPJ

ICMS/IPI

IRPJ/CSLL

The biggest partner of any business is the government, as well known by Brazilian businessmen. We propose to advise our clients not to pay more than what is due and to fight against excessive taxes charged by the tax authorities.

We are able to defend our clients from tax-deficiency notices, especially those having a more technical and detailed line of defense or that are strategic for the business (strategic litigation), as well as filing lawsuits to recover any amounts wrongly paid and/or to stay the payment thereof.

The vision from a business point of view is an advantage of our firm. The solutions offered will always be guided by the real intention of the business and the purpose of our client’s operation. For strategic cases, we offer specialized solutions, discussed by experienced professionals, with real dialogue concerning the most urgent as well as medium and long-term objectives.

Corporate solutions deliver, in turn, real management of tax processes and the information our clients need to manage them.

In recent months, we have delivered to our clients more than BRL 67 million in tax opportunities resulting from the discussion of only one of the theses we offered. We have removed more than BRL 127 million in tax claims from our clients in the same period.

We serve several sectors of the market, from industry, through agribusiness, to wholesale and retail, including large and medium-sized companies, and are specialized in the paper market.

Getting good orientation on taxes that should be paid and studying possible reductions in tax charges is the main scope of action of the LBZ tax advisory team.

The advisory team is able to analyze business models and identify the most economical tax option. It works by identifying tax incentives and special regimes that are applicable to our clients. For such, it provides advice and opinions regarding specific situations, and assists the client by clarifying daily doubts inherent to the business. The work is done in a preventive context.

Tax transaction is designed for taxpayers seeking strategic solutions for punctual tax contingencies or accumulated tax liabilities. As the pioneer in this type of work, the Corporate Restructuring Team of LBZ Advocacia has contributed to the formulation of the first procedural legal transaction involving tax matters and today LBZ dedicates all its potential to devising tax restructuring plans created in a personalized way for each of its clients.

CEO at Sharity (a crowdfunding)

Marketing analyst at Saborama Sabores e Concentrados para Bebidas (a food additive manufacturer)

Administrative and financial director at Intermarine (a boat maker)

Tax manager at Bandeirantes

Legal director at Group 1 Automotive (a car dealer)

a trade union

a paper distributor association

CAO/CFO at Permaneo Group (a digital solutions group)

Managing director at Galileo Hospital and Maternity

Manager at Abengoa Bioernergy

Director at Mosaic Fertilizers Brazil